Diminishing depreciation rate formula

R46 000 depreciation Year 1 R36 800 depreciation Year 2 R82 800 We hope these explanations and examples have helped you to. 2000 - 500 x 30 percent 450.

Depreciation Calculation

The company wants to depreciate the machine using the diminishing balance depreciation method with a rate of depreciation of 30.

. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Double Declining Balance Depreciation Method. Depreciation 462500 x 10100 46250.

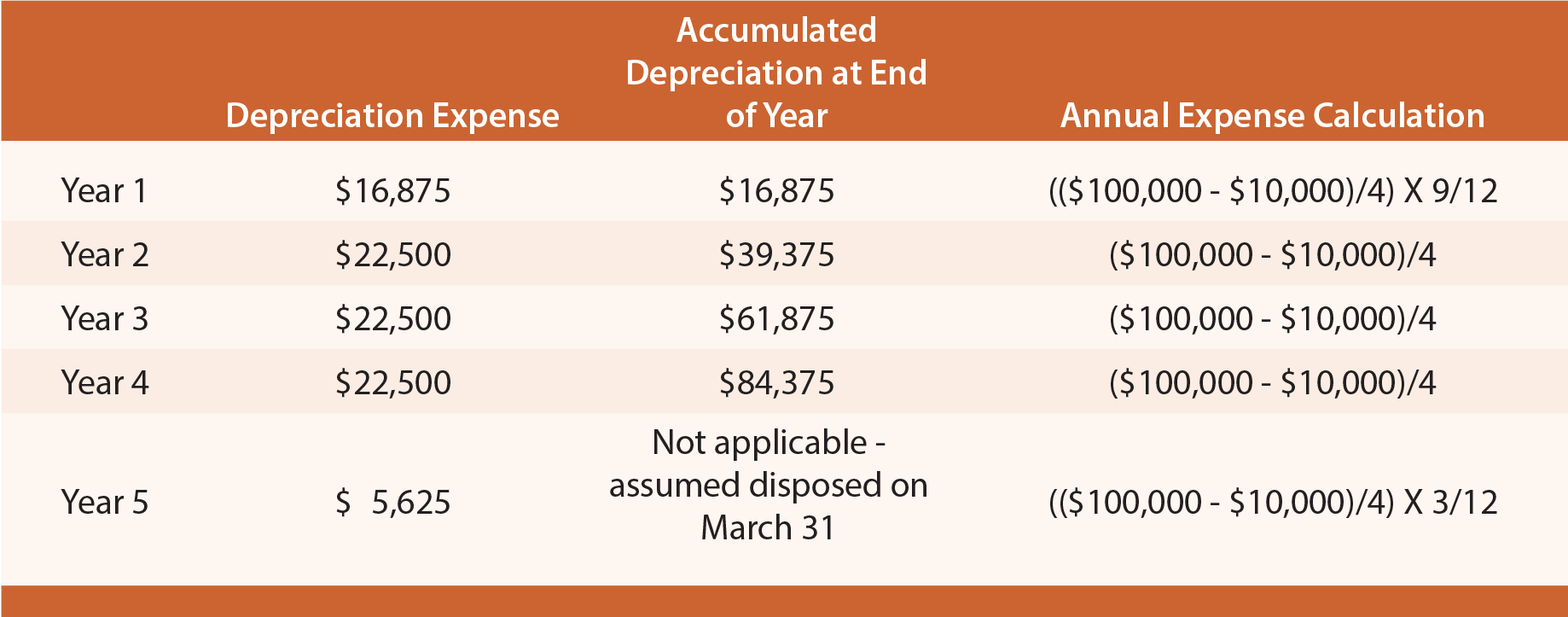

As you can see the prime cost depreciation method affords a fixed rate of depreciation. Prime cost straight line method. Cost value 10000 DV rate 30 3000.

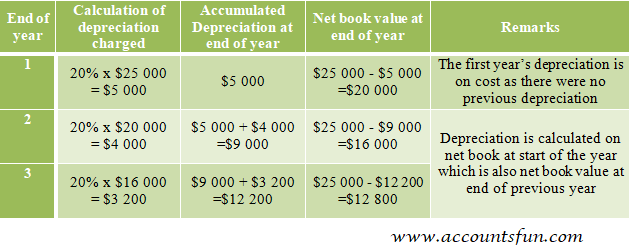

Diminishing Balance Method Example. The diminishing balance depreciation method also results in a lower depreciation expense in the. Closing balance opening balance depreciation amount.

The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Use the following steps to calculate monthly straight-line depreciation.

Year 2 2000 400 1600 x. The asset is expected to have a useful. Depreciation 374625 x 10100.

The accumulated depreciation for Year 2 will be. The double declining balance depreciation method is one of two common methods a business uses to account for the. Example of Diminishing Balance Method of Depreciation.

And the residual value is. On 01042017 Machinery purchased for Rs 1100000- and paid for transportation charge 150000- to install. Depreciation 416250 x 10100 41625.

In contrast the diminishing value method has a more significant upfront. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. If you use this method you must enter a fixed.

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Depreciation amount 1750000 12 210000.

Depreciation 500000 x 10100 x 912 37500. The rate of depreciation is applied to the diminishing value of the asset. Year 1 2000 x 20 400.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Depreciation amount opening balance depreciation rate. How to Calculate Salvage Value.

Use the diminishing balance depreciation. Subtract the assets salvage value from its cost to determine the amount that can be depreciated.

Depreciation Rate Formula Examples How To Calculate

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Declining Balance Depreciation Calculator

How To Use The Excel Ddb Function Exceljet

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

Reducing Balance Depreciation What Is Reducing Balance Depreciation

How To Use The Excel Db Function Exceljet

How To Calculate Depreciation Using The Reducing Balance Method In Excel Youtube

Written Down Value Method Of Depreciation Calculation

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation Rate Calculator Store Save 45 Countylinewild Com

Depreciation Formula Calculate Depreciation Expense

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Depreciation Formula Examples With Excel Template

Annual Depreciation Of A New Car Find The Future Value Youtube